All About Opening Offshore Bank Account

Table of ContentsOpening Offshore Bank Account Can Be Fun For AnyoneSome Known Facts About Opening Offshore Bank Account.Get This Report on Opening Offshore Bank AccountNot known Details About Opening Offshore Bank Account Top Guidelines Of Opening Offshore Bank Account

This perspective did not age well in the wake of scandals at Goldman Sachs, Wells Fargo, Barclays, HSBC, and also others.The term offshore refers to a location outside of one's residence country., financial investments, and down payments., loosened up laws, or asset security.

Opening Offshore Bank Account Fundamentals Explained

Offshore can refer to a selection of foreign-based entities, accounts, or other economic solutions. In order to qualify as offshore, the task taking location should be based in a country besides the firm or financier's residence nation. As such, while the online for a person or business may be in one country, business activity happens in one more.

Offshoring isn't generally illegal. Concealing it is. Offshoring is completely legal since it offers entities with a large amount of privacy and privacy. Authorities are worried that OFCs are being utilized to prevent paying taxes. There is raised pressure on these nations to report international holdings to international tax authorities.

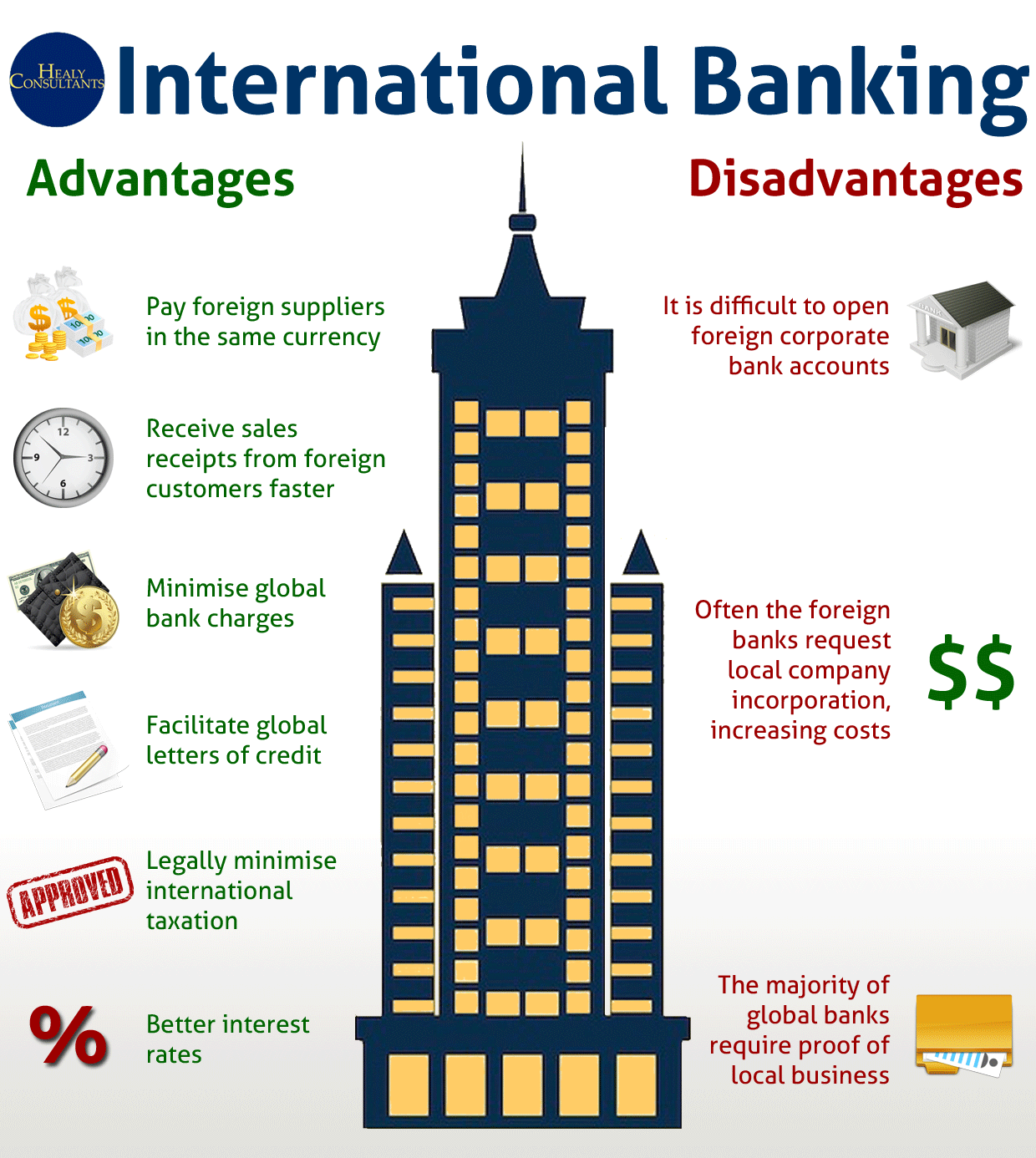

There are several kinds of offshoring: Company, investing, as well as banking. This is the act of developing specific service features, such as manufacturing or phone call centers, in a country other than where the firm is headquartered.

The smart Trick of Opening Offshore Bank Account That Nobody is Talking About

This practice is mainly used by high-net-worth capitalists, as operating offshore accounts can be especially high.

This makes offshore investing past the methods of the majority of financiers. Offshore financiers might also be scrutinized by regulatory authorities and also tax obligation authorities to ensure tax obligations are paid. Offshore financial involves securing assets in banks in foreign nations, which might be limited by the laws of the consumer's residence nationmuch like offshore investing. Holding accounts overseas topics you to more analysis. That's because it's often viewed as a means for individuals to stay clear of paying tax obligations. If you do not report your holdings to your tax obligation authority, such as the Internal Revenue Solution (IRS), you might be in severe difficulty. As discussed over, also though some territories supply complete discretion to account owners, a boosting number of countries are ending up being more clear with tax authorities.

Indicators on Opening Offshore Bank Account You Should Know

You might make money in the neighborhood money and are typically based on regional labor regulations - opening offshore bank account. You are thought about to be functioning offshore if why not try here your firm opens an office in an additional nation and moves you to that area. Onshore indicates that organization task, whether that's running a company or holding properties and also investments, takes place in your home nation.

Offshore accounts are perfectly legal, as long as they are not used for immoral purposes. Keep in mind, though, that hiding your offshore possessions is unlawful. This suggests you should report any type of and all offshore accounts you hold to your nation's tiring authority. Offshore banking explains a relationship that a company or person has with a financial institution outside the nation of their home.

Songsak rohprasit/Moment/Getty Images Offshore financial is the method of maintaining cash in a financial institution check this account located top article in a different country than the account holder's home nation. There are numerous factors why individuals pick to do this, consisting of the potential for tax benefits, property security, comfort, protection, privacy, and higher interest rates.

Opening Offshore Bank Account Things To Know Before You Get This

Offshore checking account are savings account situated in a country various other than the account owner's home nation. The account owner can utilize the account to make and get repayments, hold money, and also established savings and also investment accounts in multiple money. While offshore banking offers some tax advantages, these accounts are not a legitimate method to hide money from tax obligation authorities.

: Depending upon the nation where you live as well as the nation where the financial institution is situated, your offshore account can be tax-free or at the very least exhausted at a low rate.: An overseas account can be used to safeguard your assets in situation you're sued or your business fails.: You'll have easy accessibility to your account.